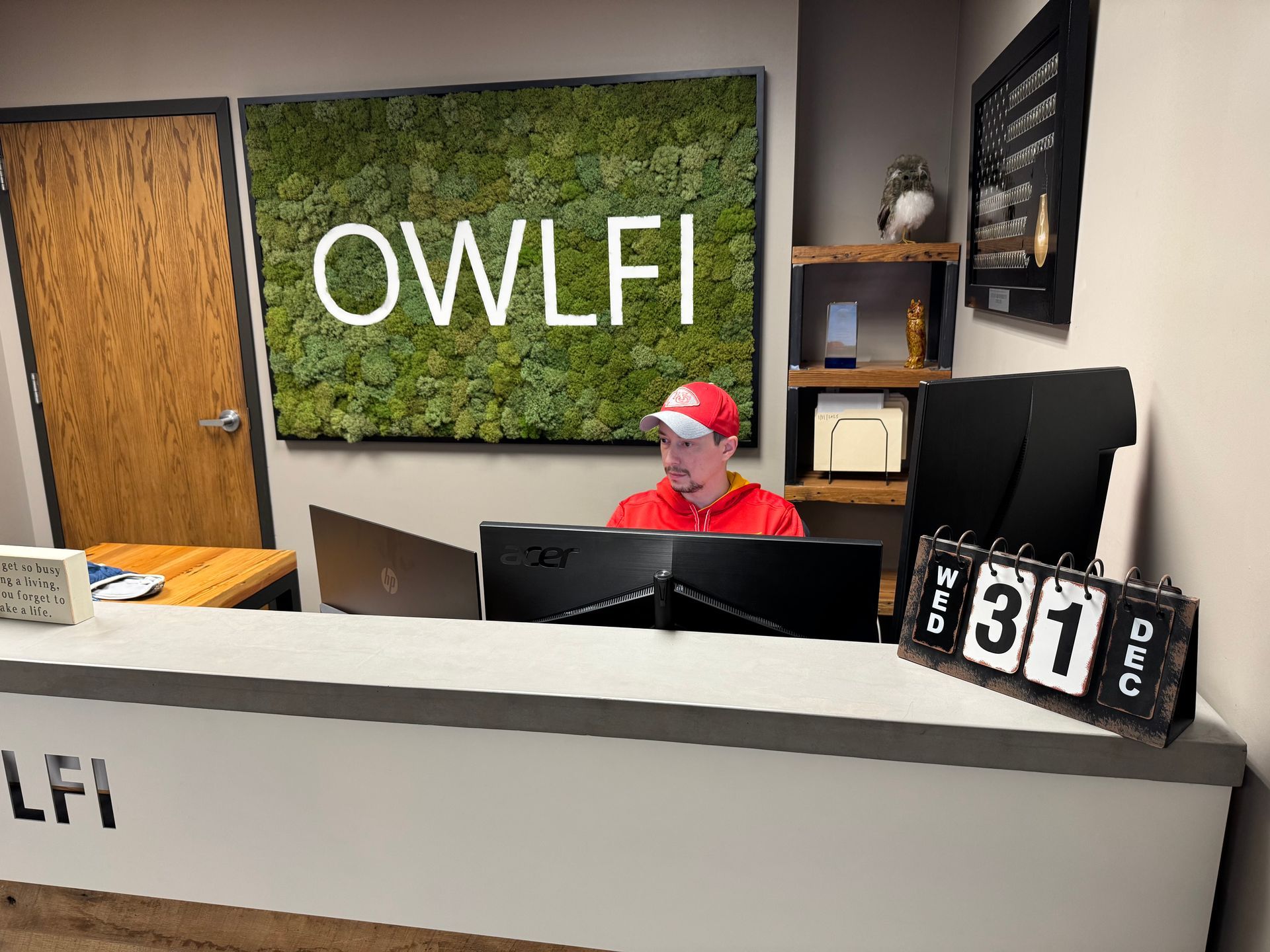

Welcome to OWLFI

Empowering our clients nationwide to make confident decisions and build a stronger financial future.

Build a Tax-Efficient Retirement That Preserves Freedom and Legacy

In retirement, taxes often become your largest expense. Without proactive planning, distributions, tax law changes, and account structure can quietly erode your wealth.

OWLFI’s Strategic Wealth Architecture is built to minimize lifetime taxes, optimize retirement income, and adapt as your life and the tax landscape evolve — so your money works for you, not against you.

Tax Strategy

Comprehensive planning to minimize tax exposure and maximize your wealth preservation.

Asset Management

Professional oversight of your investments to build reliable income for the future.

Lifestyle Planning

Customized financial roadmaps designed to support the lifestyle you've worked to achieve.

Business Owner Exit Planning

Strategic guidance to help you transition from business ownership to financial independence.

Preserve Wealth Through Expert Planning

Contact Our Financial Advisor Today in Lenexa, Kansas, Missouri, and Beyond

OWLFI helps individuals and families in Lenexa, KS and across the country build confident, tax-efficient retirement plans through truly comprehensive financial advisory services. Our financial advisor, Elliot, collaborates directly with tax professionals and attorneys to provide fully integrated guidance—ensuring every financial decision supports long-term stability, minimizes taxes, and aligns with your personal goals. With fiduciary advice, tax planning, and accounting support all in one place, we make your financial life simpler, clearer, and far less stressful.

Tax optimization is the core of our retirement planning process. From Social Security timing and tax-smart withdrawal strategies to long-term wealth preservation, we help you keep more of what you’ve earned so your retirement feels secure and meaningful. Whether coordinating with your current CPA and attorney or connecting you with trusted professionals, we ensure every strategy works seamlessly across your entire financial picture.

While our primary focus is serving individuals and families, we also support those navigating major financial transitions—including preparing for or completing the sale of a business. When transitioning out of ownership, you need strategies that turn a single liquidity event into dependable, tax-efficient income for life. Our proven process helps simplify complex decisions and preserve more of your hard-earned wealth, with recommendations tailored to your goals, values, and transition timeline.

OWLFI specializes in guiding individuals through life’s major financial moments—such as retirement and other pivotal transitions—by turning complexity into clarity and confidence. We recognize that your savings and career represent years of dedication, and we’re committed to helping you move forward with intention and purpose. Our coordinated, team-based approach brings your advisor, tax professional, and attorney into alignment at every step, creating a more seamless and strategic planning experience.

Contact OWLFI in Lenexa and surrounding areas to learn more about our tax-efficient retirement planning and comprehensive personal financial services.

Trusted Fiduciary-Based Financial Planning

Our planning stands apart through a proactive, tax-focused approach, including:

- Tax-free Roth conversion strategies

- Pairing conversions with oil & gas deductions to offset taxes

- Long-term tax horizon planning

- Proactive—not reactive—tax coordination

OWLFI Strategic Wealth Architecture

A Smarter, Purpose-Driven Way to Plan Your Retirement

Retirement planning isn’t just about making your money last — it’s about creating clarity, intention, and long-term purpose. OWLFI’s Strategic Wealth Architecture provides a modern framework built around time, risk, and meaning, giving you a system that adapts as your life and the financial landscape evolve.

The OWLFI Bucket System

A forward-looking structure that organizes your wealth by purpose and time horizon, helping you stay secure today while preparing for tomorrow.

Deck Supplies (1–3 years)

Your short-term stability bucket.

- Designed for reliable income

- Helps you avoid selling investments during downturns

- Assets: CDs, cash, money markets

Mid-Hold (4–10 years)

Your moderate-growth engine.

- Bridges the gap between safety and growth

- Refilled with gains during strong markets

- Assets: balanced funds

Deep-Hold (11+ years)

Your long-term opportunity bucket.

- Focused on higher growth potential

- Helps hedge longevity and inflation

- Assets: stocks, alternatives

Legacy Bucket (Optional)

Your impact bucket.

- For family, charitable giving, or long-term legacy plans

- Assets: trusts, donor-advised funds, giving vehicles

This system helps you avoid selling low, lock in gains during strong markets, and maintain steady income regardless of conditions. It mirrors how major institutions manage money—just with clarity and simplicity clients actually understand.

Why This Structure Matters

Traditional retirement strategies were built for a world that no longer exists. Today’s retirees face longer lifespans, more volatility, and an evolving tax landscape. Your plan must be dynamic—not static.

OWLFI’s architecture adapts to:

- Market cycles

- Tax-law changes

- Shifting income needs

- Longevity and legacy goals

It’s not “set it and forget it.” It’s purposeful, proactive, and flexible, allowing you to move from survival to significance.

This system helps you avoid selling low, lock in gains during strong markets, and maintain steady income regardless of conditions. It mirrors how major institutions manage money—just with clarity and simplicity clients actually understand.

Coordinated Planning Across Multiple Disciplines

Even with a single advisor, your plan touches multiple professional areas. Most people work with a CPA, attorney, insurance agent, and financial advisor who rarely communicate. OWLFI eliminates the fragmentation.

We Coordinate Your Entire Financial Crew:

- Tax strategy – proactive modeling, tax-horizon planning, and preparation for future tax-rate shifts

- Legal strategy – alignment with estate documents, trusts, and legacy intentions

- Income planning – structured withdrawals tied to bucket timing and market conditions

- Risk planning – protecting income, managing exposure, and preparing for uncertainty

This integrated approach provides the clarity and cohesion of a private-office experience—without the complexity or inaccessibility

The Outcome: A Retirement of Significance

Once your income is secure and your taxes are strategically managed, you gain the freedom to focus on what truly matters: purpose, giving, mentoring, and living out the life you’ve built.

OWLFI doesn’t just manage portfolios — we strategize voyages of significance.

Comprehensive Financial Advisory Services

We offer a full range of services designed to help you navigate every aspect of your financial transition. From retirement income and tax planning to long-term lifestyle and legacy planning, our team provides the strategic guidance you need to make informed, confident decisions about your future.

What sets us apart is our proactive and highly specialized approach to tax planning—an area where most advisory firms do not go beyond basic recommendations. Our process integrates advanced tax strategies directly into your wealth plan, allowing your assets to work more efficiently over your entire lifetime.

Here’s how we help our clients secure their financial futures:

Advanced Tax Strategy

We go well beyond traditional tax planning by offering:

• Tax-free Roth conversion strategies designed to minimize or eliminate taxes on future retirement income

• Roth conversion planning paired with oil & gas deductions to help offset taxable income and create significant long-term tax advantages

• Long-term tax horizon planning to optimize your financial picture not just this year, but for decades to come

• Proactive—not reactive—tax work, ensuring strategies are implemented before year-end, not after opportunities are lost

These strategies set us apart from most advisory firms and allow us to deliver results that meaningfully impact your long-term wealth.

Asset Management

Thoughtful, evidence-based portfolio construction designed to create durable and reliable income streams in retirement.

Lifestyle Planning

Comprehensive planning tailored to the unique needs of local and national business owners and families, ensuring your financial life supports the lifestyle you want—today and in the future.

Business Owner Exit Planning

Guidance through every stage of transitioning from ownership to financial independence, ensuring clarity and confidence throughout the process.

We offer both virtual and in-person meetings to fit your schedule and preferences.

Schedule your free introductory consultation to explore how we can help you in Lenexa, Kansas, Missouri, or nationwide,

Why Successful People Choose OWLFI

OWFli specializes in guiding individuals and families through comprehensive, fiduciary-based planning powered by our proprietary Strategic Wealth Architecture™. We turn confusion into confidence, transforming retirement from a life of uncertainty to a life of significance.

Whether you’re structuring retirement income, minimizing taxes, designing long-term income strategies, or planning how to preserve wealth for your family, our approach gives you peace of mind and a clear path forward.

And for those who happen to be transitioning a business as part of retirement, we integrate that into your overall plan in a tax-efficient, emotionally grounded way.

We coordinate seamlessly with accountants and attorneys to ensure every piece of your financial life works together.